Buy Now, Pay Later for Smartphones: How Monthly Payments Work

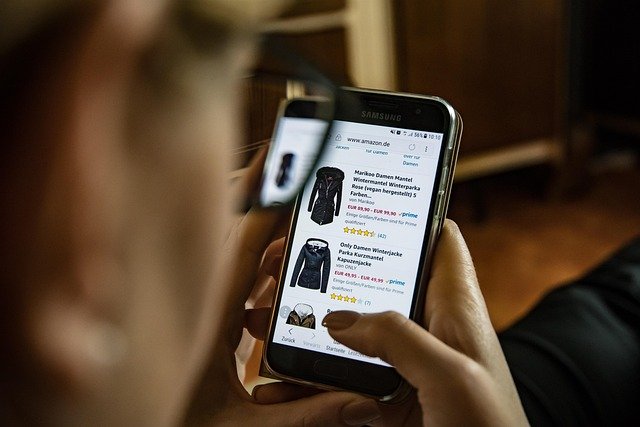

Monthly payment options make it easier for people to get smartphones without paying the full price upfront. With buy now, pay later programs, users can enjoy new devices and manage costs in smaller, more manageable installments. Learn how this option works and what to consider. Discover more in this article.

What is Buy Now, Pay Later for Smartphones?

Buy Now, Pay Later for smartphones is a financing option that allows consumers to purchase a mobile device without paying the full price upfront. Instead, the cost is spread out over a series of monthly payments, typically ranging from 6 to 24 months. This approach makes high-end smartphones more accessible to a broader range of consumers who might otherwise struggle to afford the latest models.

How Do Monthly Payment Plans for Phones Work?

Monthly payment plans for phones operate on a simple principle: divide the total cost of the smartphone into equal monthly installments. Here’s a general breakdown of the process:

-

Choose your device: Select the smartphone you want to purchase.

-

Apply for financing: Complete an application with the retailer or financing company.

-

Get approved: Based on your credit score and financial history, you’ll be approved or denied.

-

Set up payments: If approved, you’ll agree to a specific payment term and monthly amount.

-

Receive your phone: Once the agreement is in place, you can take your new phone home.

-

Make monthly payments: You’ll pay the agreed-upon amount each month until the balance is paid off.

What Are the Benefits of Smartphone Financing Options?

Smartphone financing options offer several advantages to consumers:

-

Affordability: By spreading the cost over time, expensive devices become more manageable for many budgets.

-

Access to latest technology: Users can upgrade to newer models more frequently without large upfront costs.

-

Improved cash flow: Keeping more money in your pocket each month can help with overall financial planning.

-

Potential for 0% interest: Some plans offer interest-free periods, making the total cost equivalent to paying upfront.

-

Credit building: Regular, on-time payments can potentially improve your credit score.

Are There Risks to Pay Monthly for Mobile Devices?

While pay monthly options for mobile devices can be attractive, there are some potential downsides to consider:

-

Long-term commitment: You’re typically locked into a contract for the duration of the payment plan.

-

Interest charges: If not paid off during a promotional period, interest can significantly increase the total cost.

-

Credit impact: Late or missed payments can negatively affect your credit score.

-

Overspending: The lower monthly payments might tempt you to choose a more expensive phone than you need.

-

Depreciation: You may end up paying for a device that’s worth less than your remaining balance if you want to upgrade early.

How to Choose the Right BNPL Plan for Your Smartphone?

Selecting the best Buy Now, Pay Later plan for your smartphone requires careful consideration:

-

Compare interest rates: Look for plans with low or 0% interest rates, especially during promotional periods.

-

Check the term length: Shorter terms may have higher monthly payments but less overall interest.

-

Understand the fine print: Be aware of late fees, early payoff penalties, or other hidden charges.

-

Consider your budget: Ensure the monthly payments fit comfortably within your financial plan.

-

Evaluate the total cost: Calculate the full amount you’ll pay over the life of the plan and compare it to the upfront price.

Popular Smartphone Financing Options and Providers

Several major carriers and retailers offer Buy Now, Pay Later options for smartphones. Here’s a comparison of some popular providers:

| Provider | Payment Term | Interest Rate | Key Features |

|---|---|---|---|

| Apple iPhone Payments | 24 months | 0% APR | Includes AppleCare+, easy upgrades |

| Samsung Financing | Up to 36 months | 0% APR on select models | Flexible terms, instant credit decision |

| Verizon Device Payment | 24-30 months | 0% APR | No down payment required on many devices |

| T-Mobile Equipment Installment Plan | 24-36 months | 0% APR | $0 down for well-qualified buyers |

| Best Buy Progressive Leasing | 12 months | Varies | No credit needed, early buyout option |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Buy Now, Pay Later for smartphones has transformed the way consumers access the latest mobile technology. By offering flexible payment options, these plans make high-end devices more attainable for many. However, it’s crucial to carefully evaluate the terms, understand the total cost, and consider your long-term financial obligations before committing to a monthly payment plan. With the right approach, you can enjoy the benefits of a new smartphone while maintaining financial stability.